BusinessWire India

Bengaluru (Karnataka) [India], October 6: The eCommerce industry is on the cusp of a record-breaking year, poised for a strong festive season. According to Velocity's proprietary data aggregated across 3500+ businesses, ecommerce has grown by 41% in the July to September 2023 quarter compared to the same quarter in 2022 and 25% quarter on quarter.

This rapid growth in D2C and ecommerce is set against a backdrop of declining Venture Capital (VC) funding. Encouraged by the online surge caused during Covid-19, VC funding increased in the years 2019 all the way to 2021, and reached an all-time high at H2 CY2021. Since then, it has seen a sharp decline of more than 80% that has brought it to a mere USD 3.8Bn in H1 of 2023.

While funding through venture capital has its advantages, it is also time-consuming and demanding due to the long decision-making process. For the D2C and ecommerce sector that undergoes significant seasonal changes, VC financing may not be ideal due to its limited availability and equity-diluting model. Additionally, securing funding often involves restrictive terms and covenants, adding complexity to the process. All these factors, along with a slowdown in VC investments, are driving more entrepreneurs towards alternative financing models which are known to be relatively more transparent, fast and flexible.

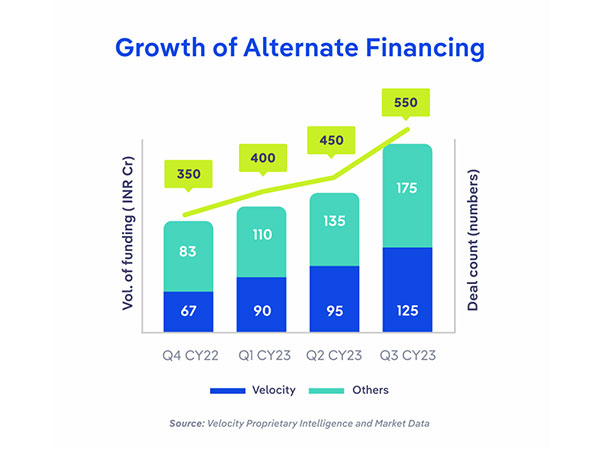

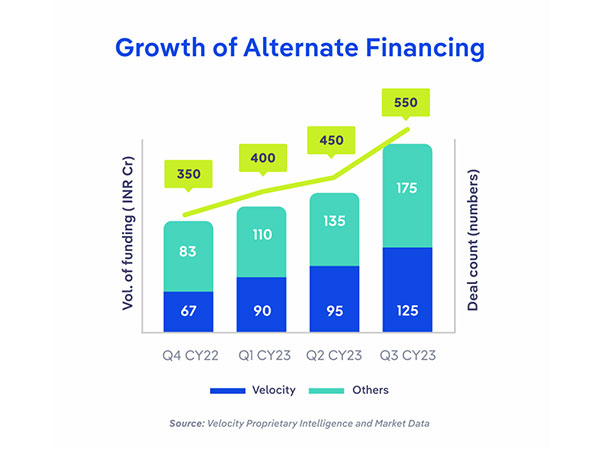

As traditional funding sources recede, alternate financing models, especially revenue-based financing, have emerged to fill the void with prominent players including Velocity, Klub, Recur, GetVantage, and others. In the last six months, these alternate financiers have collectively deployed over INR 500 Crore to support ecommerce brands in preparation for the upcoming festive season.

Market estimates indicate that this influx of capital is set to fuel a surge in eCommerce growth. Notably, Velocity has played a significant role in this financial backing, contributing a substantial INR 220 Crore over the last six months, with the remaining capital sourced from other key players in the alternate financing sector. As D2C brands and ecommerce companies look for investments to procure higher inventory levels and marketing spends for the forthcoming festive sales, flexibility and agility of alternative financing has enabled them to thrive and seize these opportunities.

A deeper analysis of alternate financing shows that over a 1000 brands have been funded in just the last six months, with Velocity alone accounting for a staggering 600 of them. Velocity's funding expertise extends across a diverse spectrum of sectors, including apparel and footwear, beauty and personal care, healthcare and supplements, home and garden, consumer electronics, and food and beverages. Velocity has deployed a total of over INR 600 Cr across 1800+ investments since its inception, showcasing their commitment to fueling growth for the underserved e-commerce segment.

Abhiroop Medhekar, the Co-Founder & CEO of Velocity, said, "Velocity has witnessed a remarkable 3X year-on-year growth in our deal flow. The demand for financing from ecommerce brands is through the roof, and we are dedicated to meeting this demand head-on. We believe in empowering businesses with flexible, founder-friendly financing solutions that fuel their growth."

Mamta Roy, Founder of Odette quoted, "As a founder, retaining ownership and control was very important to me. As VC Funding involves equity dilution, we wanted to steer away from it until it was absolutely required for our growth. Revenue-based financing is a good option for founders who want to avoid giving up control and also grow without any external pressure."

As eCommerce continues its meteoric rise, these alternate financiers are at the forefront of this financial transformation, playing a critical role in nurturing the industry's growth. With their substantial investment capacity and commitment to clients, these financiers are well-positioned to propel eCommerce success into the future.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by BusinessWire India. ANI will not be responsible in any way for the content of the same)