PRNewswire

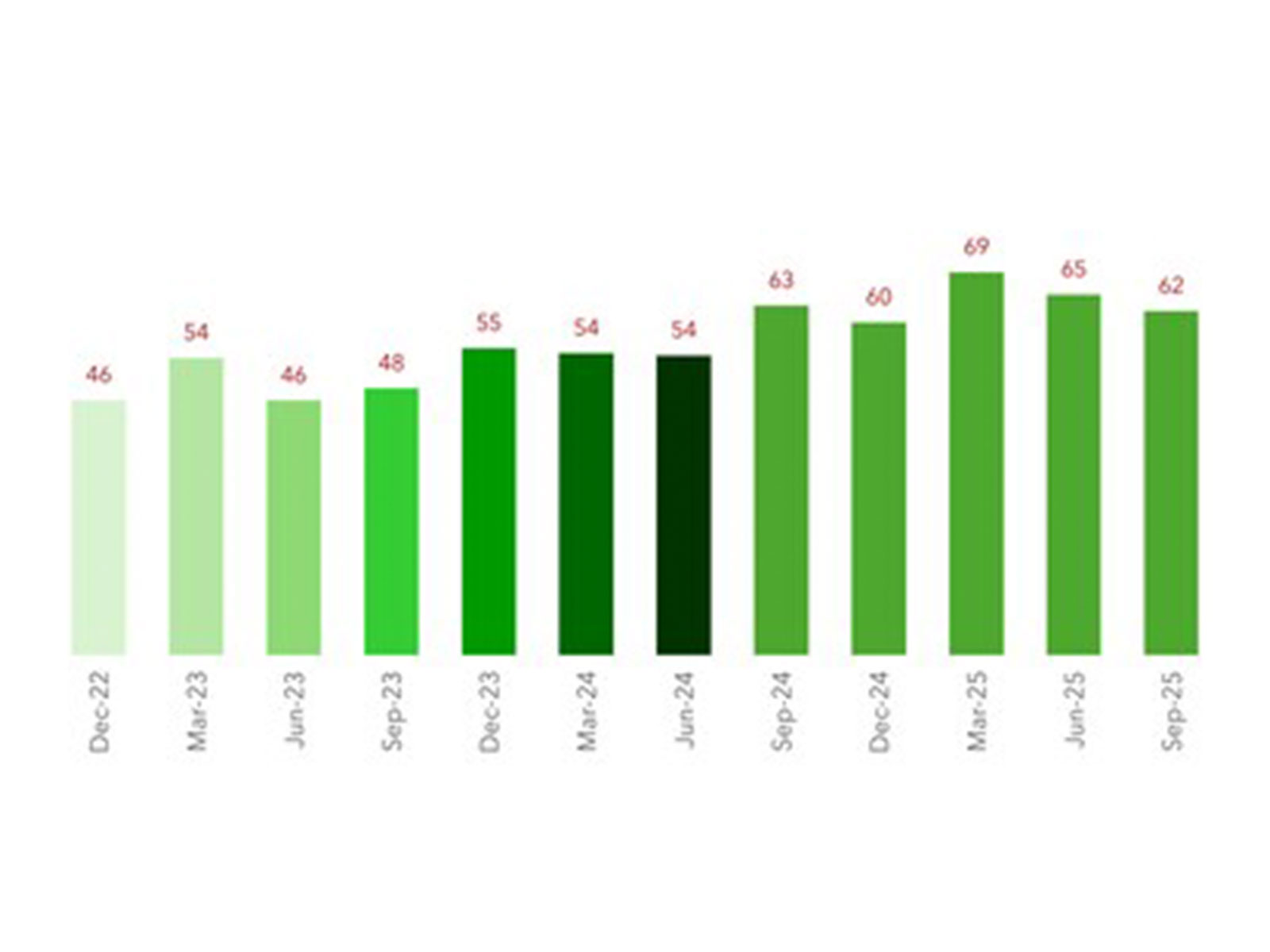

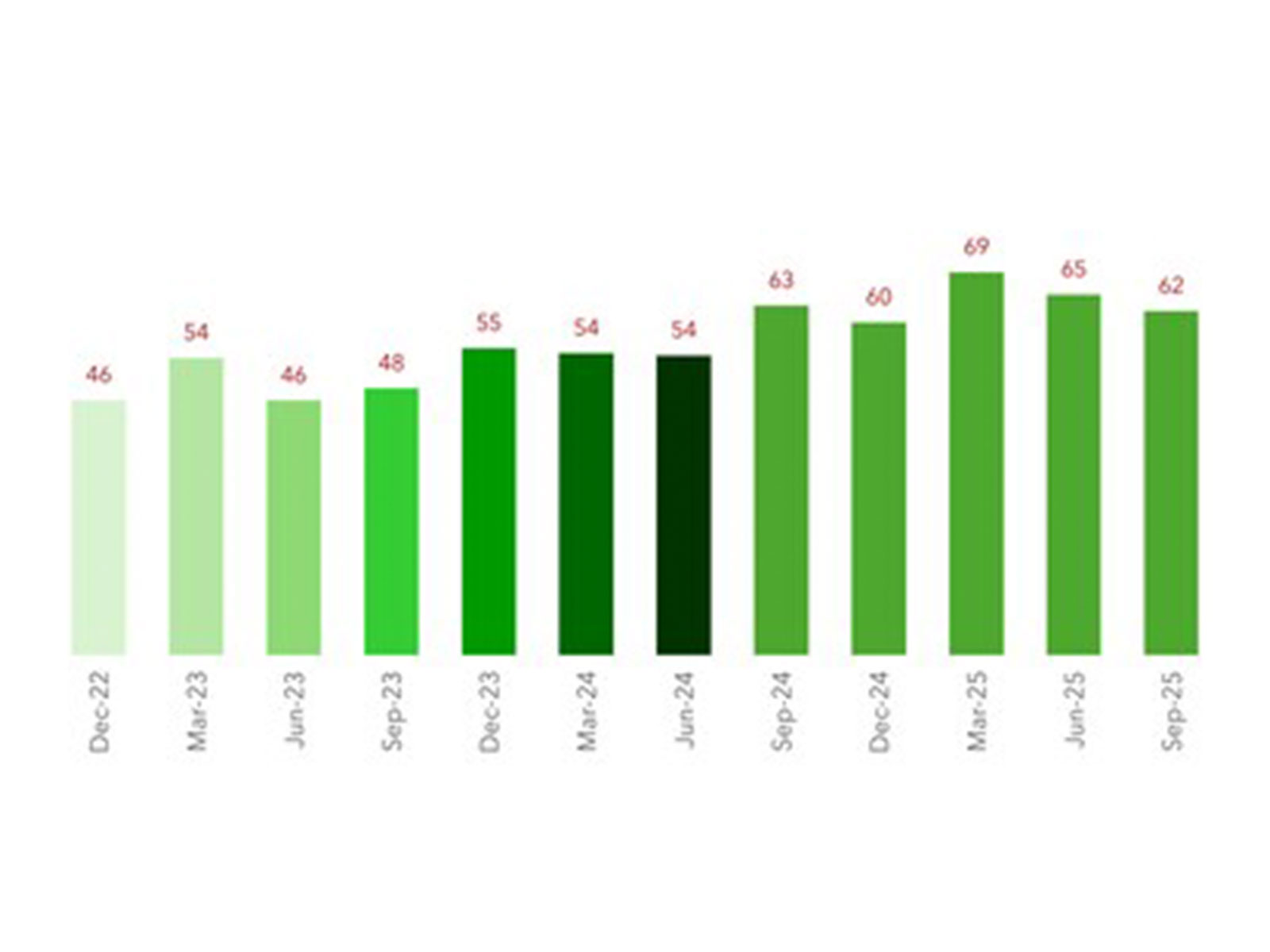

Mumbai (Maharashtra) [India], February 12: Dun & Bradstreet, a leading global provider of business decisioning data and analytics, along with SIDBI, released Sustainability Perception Index (SPeX), referred as the 'Green Pulse Indicator' for July-September 2025 period. SPeX evaluates Micro, Small and Medium Enterprises' (MSME's) perception of sustainability across three dimensions: willingness, awareness, and implementation. The SPeX Index moderated 2% YoY to 62, driven primarily by a decline in sustainability awareness, particularly among micro and medium enterprises. The index reflects growing sustainability willingness (+10%) and implementation (+18%) as MSMEs show greater readiness to embed sustainability into core operations, despite softer awareness.

Despite this moderation, the findings point to a clear shift from awareness to action. Environmental priorities, especially recycling and sustainable packaging, continue to gain momentum, with older and medium-sized firms are leading the expansion of sustainability initiatives. While challenges such as funding constraints and technical capacity persist, MSMEs are increasingly aligning with global sustainability trends and building capabilities across key pillars. With targeted support, this momentum could translate into scalable, long-term impact.

Dr. Arun Singh, Global Chief Economist, Dun & Bradstreet, said, "While overall scores dipped 2% year-on-year due to lower awareness among micro and medium enterprises, there was a strong rise in willingness and implementation. This shows that many firms are shifting from understanding sustainability to actively adopting it. Older businesses continue to link sustainability with better export access, while more MSMEs now see it as a path to higher profits and stronger reputations. There is also a noticeable shift from governance reforms to environmental action, with recycling and sustainable packaging gaining momentum. Despite financial challenges, especially for older firms, MSMEs are prioritizing sustainable supply chains. With the right policy and financial support, they are well-placed to drive inclusive and resilient growth in the coming quarters."

Dr. Ravindra Kumar Singh, Chief General Manager, Green Climate Finance Vertical, SIDBI stated, "The latest Green Pulse Survey, for the Quarter July - September 2025, results are a powerful indicator that sustainability is not just a moral imperative, but a sound business strategy. The unprecedented 90% confidence level among businesses aged 25 years and older that sustainability adoption will enhance profitability -- a five-quarter high -- underscores a clear market shift. Enterprises are increasingly recognizing the tangible benefits of integrating environmental and social factors into their core operations. While our established "Panchatatva" Missions- spanning Energy Efficiency, Renewable Energy, E-Mobility and Circular Economy and Nature Based Solutions - are accelerating this momentum, SIDBI's endeavour to bring in more Innovative and Impactful Initiatives continue. This includes the upcoming GCF funded "Financing Mitigation and Adaptation Projects (FMAP) for Indian MSMEs and the "EN-Trans" RSF Facility for nanopreneurs and micropreneurs. These initiatives are designed to meet the growing demand for green finance and to support MSMEs in their transition to a cleaner, more resilient, and ultimately, more profitable future. These collaborative efforts, blending traditional wisdom with modern climate finance mechanisms, are crucial to accelerating the transition to a low-emission, climate-resilient economy for the envisioned Viksit Bharat."

Highlights of the SPeX Report - Q3 2025

Overall Trends

* The SPeX Index declined 4.6% QoQ to 62, driven by a fall in the awareness pillar.

* Although MSMEs awareness around sustainability declined in Q3, firms are increasingly transitioning from awareness to implementation, with 54% now classified as "integrators."

* Willingness to implement environmental policies -- especially recycling and sustainable packaging surged, replacing governance reforms as the top priority.

* A majority of MSMEs recognised sustainability as a lever for profitability (86%), cost reduction (69%), and export market access (72%), aligning with global policy trends.

* Despite growing intent, 45.2% of MSMEs lacked dedicated sustainability budgets, and only 16.3% allocated between 5-10% of their total expenditure, highlighting financial constraints.

* Bihar, Tripura, and Goa show a 5% QoQ rise in SPeX scores, while Chhattisgarh and Madhya Pradesh experience sharp declines, indicating uneven regional progress in sustainability adoption.

Awareness

* Awareness among MSMEs declined by 14% QoQ, the lowest in 10 quarters.

* Micro and medium enterprises noted the sharpest drop, with mid-aged (5-10 years) and older firms (25+ years) experiencing a 12-percentage point decline. Despite the fall, 55% of firms are actively gathering information on government reforms, and 41% are consolidating data for social initiatives--indicating a shift toward implementation readiness.

* News and social media have emerged as the most trusted sources for sustainability information (37%), surpassing government platforms (20%), especially among micro businesses.

* Awareness of sustainability benefits -- like profitability and export access -- is rising, with 86% of MSMEs recognising profit gains, a rise of 10 percentage points QoQ, and 72% acknowledging improved market reach, especially among older firms.

Willingness

* Willingness to implement sustainability measures increased by 10% QoQ, led by older and mid-aged businesses, marking the sharpest increase since Q4 2023.

* MSMEs prioritised Reduce, Reuse, Recycle (3R) (31%) and DEI reforms (25%), over employee welfare (18%) and full compliance with the guidelines and the regulations (11%) in Q3 2025.

* 60% of MSMEs focused on making supply chains more sustainable and 57% on updating existing strategies.

* Medium enterprises have shown strong intent, with 90% planning to expand environmental initiatives -- a 53 percentage point surge--while micro enterprises saw a 22-point rise in full implementation readiness.

* Peer pressure, cost efficiency, and monetary and non-monetary incentives remain key motivators across business sizes and ages to adopt sustainability practices -- with younger firms and micro enterprises especially influenced by competitive dynamics.

* Despite reduced focus on employee welfare, businesses across all age groups are actively building expertise in sustainability, with 64% expanding strategies and 62% improving supply chains.

Implementation

* Implementation scores rose by 18% QoQ, led by medium enterprises and businesses aged 10-25 years, indicating a strong recovery from Q2 2025.

* Recycling and sustainable packaging has gained traction, with 46% of MSMEs implementing recycling procedures and 50% of micro enterprises adopting sustainable packaging, an increase of 31 percentage point QoQ.

* Medium businesses lead the focus on environment reforms/policies, with 65% in process of implementing sustainability training and 90% expanding environmental initiatives.

* Cost of implementation, lack of technical expertise, and capital availability remain consistent challenges across all sizes and ages, though internal management resistance has notably declined.

* Younger businesses are increasingly planning full compliance, with 58% of firms aged 1-5 years preparing for prompt implementation, while older firms continue to face cost-related barriers despite high intent.

* Goa is the only state out of the total 22 states surveyed, where majority of respondents - 14% are already implementing sustainability measures.

Methodology

The SPeX Index ranges from 0 to 100 and tracks MSMEs' evolving perception of sustainability. Movements in the index reflect changes across three key dimensions:

* Awareness - understanding of sustainability measures and policy support.

* Willingness - intent and motivation to adopt sustainability practices.

* Implementation - actual execution of sustainability actions.

An increase in the SPeX value indicates strengthening perceptions and adoption momentum, while a decline signals emerging challenges or weakening sentiment.

The findings are based on a survey of MSMEs across 22 states, covering micro, small, and medium enterprises across different business age groups. The survey was conducted for the period July-September 2025 with a statistically valid sample size.

About Dun & Bradstreet:

Dun & Bradstreet, a leading global provider of business decisioning data and analytics, enables companies around the world to improve their business performance. Dun & Bradstreet's Data Cloud fuels solutions and delivers insights that empower customers to accelerate revenue, lower cost, mitigate risk and transform their businesses. Since 1841, companies of every size have relied on Dun & Bradstreet to help them manage risk and reveal opportunity. For more information on Dun & Bradstreet, please visit www.dnb.com.

Dun & Bradstreet Information Services India Private Limited is headquartered in Mumbai and provides clients with data-driven products and technology-driven platforms to help them take faster and more accurate decisions in domains of finance, risk, compliance, information technology and marketing. Working towards Government of India's vision of creating an Atmanirbhar Bharat (Self-Reliant India) by supporting the Make in India initiative, Dun & Bradstreet India has a special focus on helping entrepreneurs enhance their visibility, increase their credibility, expand access to global markets, and identify potential customers & suppliers, while managing risk and opportunity.

India is also the home to Dun & Bradstreet Technology & Corporate Services LLP, which is the Global Capabilities Center (GCC) of Dun & Bradstreet supporting global technology delivery using cutting-edge technology. Located at Hyderabad, the GCC has a highly skilled workforce of over 500 employees, and focuses on enhanced productivity, economies of scale, consistent delivery processes and lower operating expenses.

Visit www.dnb.co.in for more information. Click here for all Dun & Bradstreet India press releases.

About SIDBI:

Small Industries Development Bank of India (SIDBI) in its role as the Principal Development Finance Institution for MSME sector has played a significant role in developing the financial services for MSME sector through various interventions including Refinance to Banks, Credit Guarantee programs, Development of the MFI sector, Contribution to Venture capital/AIF funds, MSME ratings, promoting digital lending ecosystem, etc. The Bank has proactively been working toward Energy Efficiency (EE) in MSMEs since 2005-06 as part of Direct Finance business using support of multilaterals like World Bank, ADB, GiZ, FCDO, JICA, AFD, KfW etc. for energy efficient projects. SIDBI has taken steps to promote Energy Efficiency and Cleaner production in the MSME sector and propose to accelerate its efforts for MSME sector for their survival, growth, and competitiveness in long run during prevailing climate related challenges.

Looking to importance of ESG aspects and the need for a simplified, Customised ESG risk rating framework, SIDBI has already started integration of ESG framework into its operations. Subsequent to setting up of Green Climate Finance Vertical for prioritised focus, a Board level Committee has been constituted for guidance, oversight, and monitoring on ESG, Green Strategy of the bank, including relevant SDGs etc. To lead with the example, SIDBI has set a target to become Carbon Neutral by 2024 and Net Neutral organization in subsequent years.

Through Green Financing products and other developmental activities, SIDBI enables the manufacturers and service providers in MSME sector to adopt green energy efficient technologies helping in lesser waste leading to positive impact on environment and sustainability.

Visit www.sidbi.in for more information.

Disclaimer:

This report and index are based on aggregated and anonymised survey responses and reflect respondents' perceptions. They do not constitute a sustainability rating, certification, regulatory advice, or a forecast or guarantee of business performance. All insights are indicative and intended for informational purposes.

Photo - https://mma.prnewswire.com/media/2902102/SPeX_Q3_2025_Graph.jpg

Logo - https://mma.prnewswire.com/media/2867256/Dun_Bradstreet_Logo.jpg

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same)